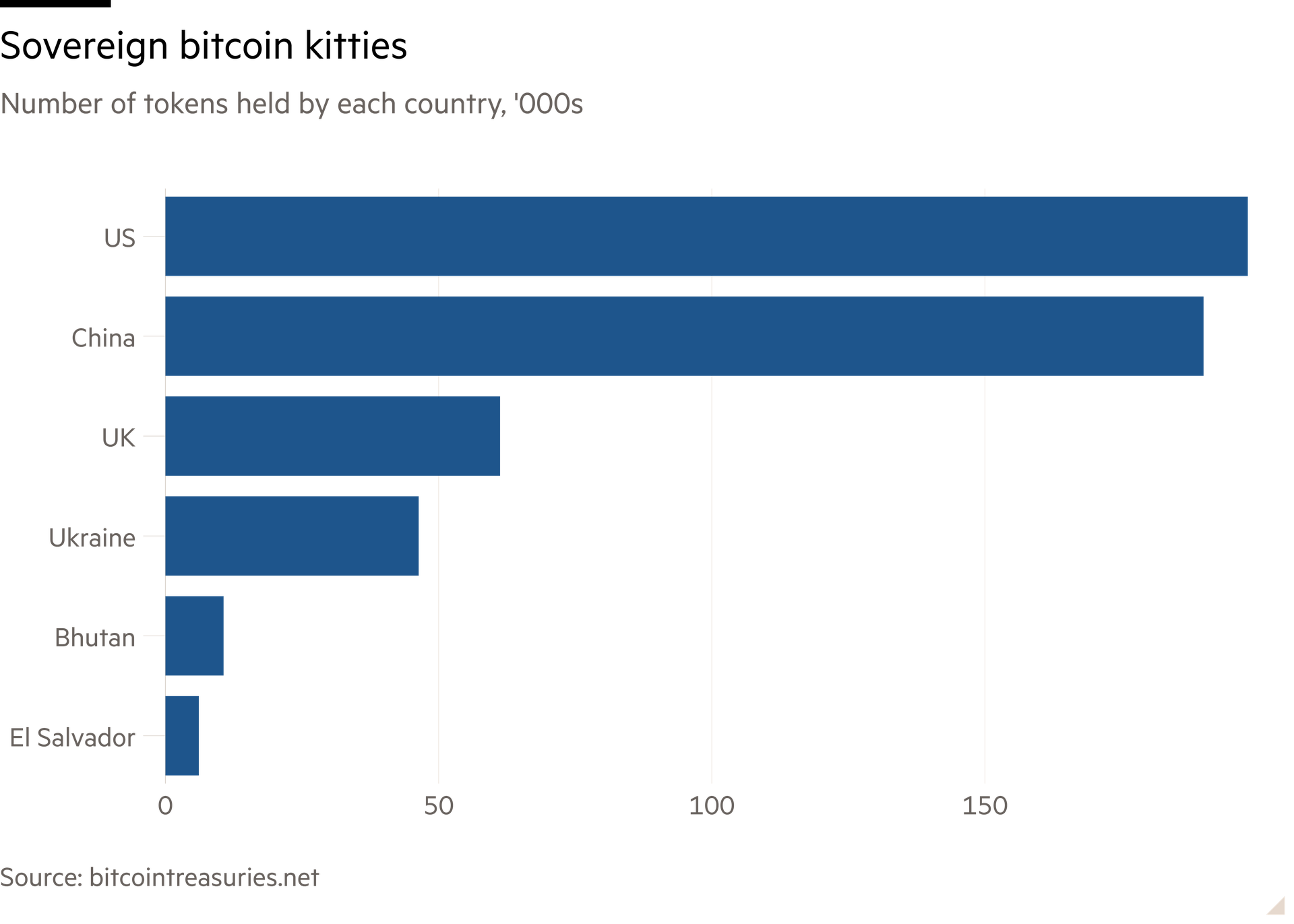

Donald Trump may have called for a strategic bitcoin reserve — but while the US president grabs headlines, other sovereigns are quietly amassing their own kitties. Bhutan, a tiny kingdom so esoteric it measures happiness the way more humdrum counties measure economic output, holds the fifth biggest national bitcoin stash.

Countries come by their tokens in different ways. Crime kick-started Washington’s booty. US federal law enforcement seized bitcoin when taking down the Silk Road online marketplace — assets in this case being the bitcoin buyers used to purchase drugs, arms and other contraband on the dark web. Forfeits from crime also explain the UK’s 61,000-odd bitcoin, as of the end of December.

Bhutan’s haul derives from a more wholesome source. The Himalayan kingdom mines its own coins, harnessing rivers to power the computers. There is a nice circularity to this. Exporting hydropower would be expensive and inevitably require new infrastructure, not all of which would necessarily be aesthetically pleasing. So instead Bhutan monetises the energy — turning gigawatts into money — by mining bitcoin at home. That’s helpful for a country with few wealth-generating levers at its disposal; it imports nearly everything and manufacturing is a non-starter.

Britain’s holding is around five times the size of Bhutan’s, but much smaller relative to the economy. Even at bitcoin’s peak it wouldn’t cover a fortnight’s funding for the health service.

Sovereigns talk up the inflationary hedge aspect of this “digital gold”. Like gold, its scarcity value theoretically protects it from inflationary pressures — although in practice bitcoin has proved too volatile to make the case.

But there are obvious risks to states holding chunks of a highly volatile asset backed by nothing more than lines of code. Current kitty sizes may not be enough to raise hackles, but recent months have highlighted yet again just how wild this ride can be. The Trump bump pushed bitcoin past $105,000 in January but, like other assets, it has since lost ground and now sits at just over $83,000.

Buyers in the wake of the coin’s Trump bump include Saudi Arabia, traders reckon. El Salvador, undeterred by the strings attached to a pending IMF bailout, continued to buy bitcoin last month.

China may, or may not, have a kitty not far short of Washington’s. To a country keen to diversify away from the dollar and comfortable stockpiling everything from pork to critical minerals, a strategic bitcoin reserve might not seem outlandish. True, the token is banned in the People’s Republic, but exceptions can always be made.

Sovereign bitcoin reserves are a relatively small phenomenon but they are probably here to stay. One reason is that old-school currency reserves are also becoming riskier. See, for instance, speculation that the US might pursue a so-called Mar-a-Lago accord to weaken the dollar. Should a new monetary system come about, that might just create a space for an alternative like bitcoin.