M&G’s fund managers have supported numerous corporate demergers in the name of unlocking shareholder value. Indeed, the same logic was part of M&G’s separation from Asia-focused insurer and savings group Prudential at the end of 2019.

That move popped the joint valuation for a while. After this, Pru slipped on China worries and M&G moved sideways. Some investors are now mooting a further break-up of the UK savings and investments group.

Schroders mulled a bid for M&G at the beginning of last year. It would have hung on to asset management while disposing of the life and pension businesses. The deal foundered over concerns about a culture clash and slumping investment flows.

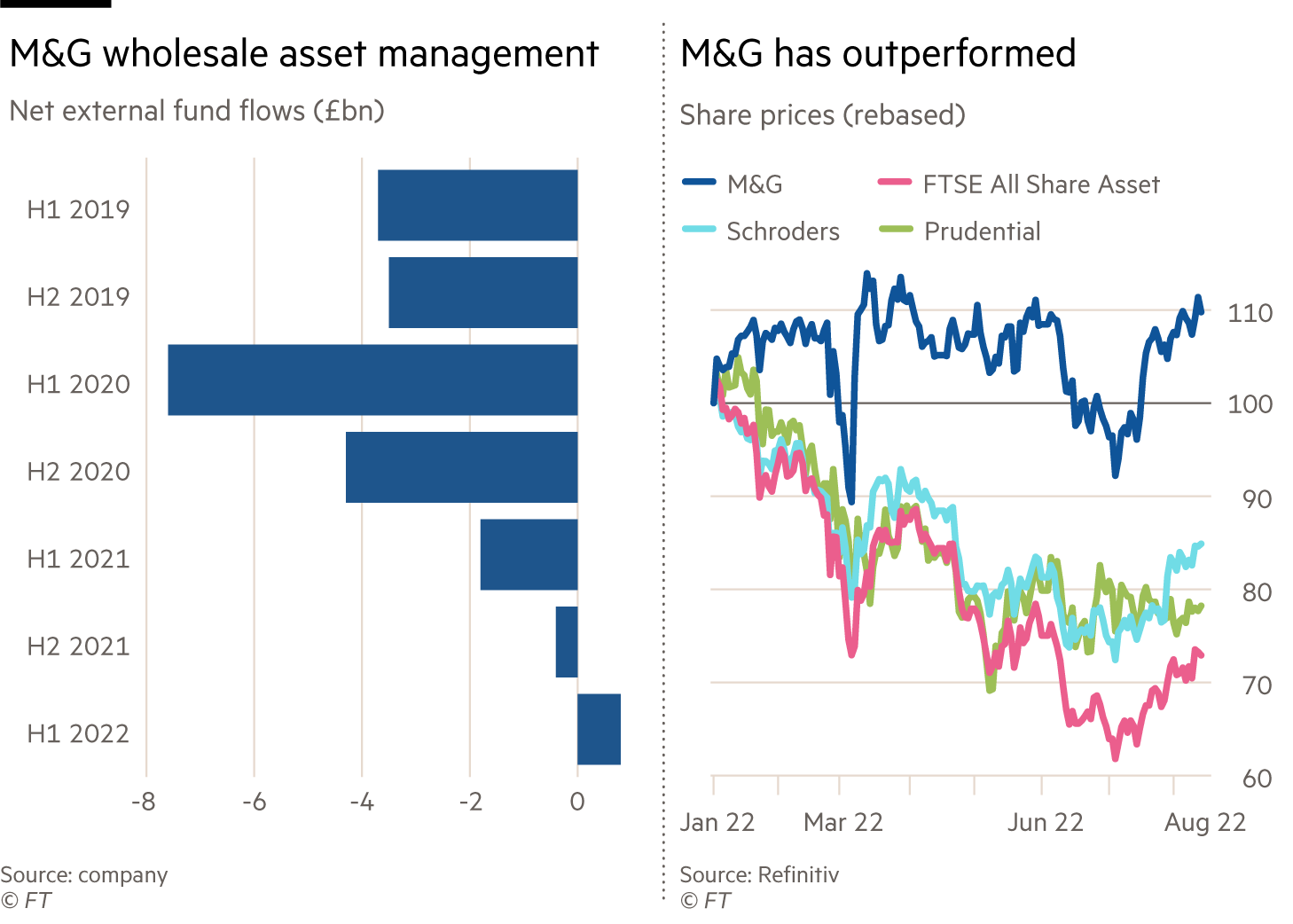

These turned positive in the first half of this year for the first time since the demerger. A higher price for the group’s most valuable division should be warranted.

At £5.6bn, M&G’s market value is just a hair below its listing value. A group valuation multiple of 10 times forward earnings is well below 14 times for Schroders. M&G’s lower rating reflects slower growth and its reliance on unfashionable savings and pension products.

These include a large back book of annuities and with-profit insurance policies, along with the flagship PruFund, which remains open to new business.

The with-profits businesses might be worth 20 per cent of own funds, or £3bn. Other insurance businesses could attract £4.5bn, including net debt, equating to 76 per cent of own funds, think analysts at RBC. Add in £2.4bn for the asset management business on a 14 times multiple and any savings a consolidator might find. That implies 40 per cent upside from a break-up over the current price.

However, a deal would have to be all or nothing. A partial sale of the back book, for example, would scupper a dividend currently yielding over 8 per cent. Meanwhile, M&G is tipped to benefit from Solvency II reforms. Its shares have outperformed peers by nearly 40 per cent this year.

Investors should wait and see whether a new chief executive can squeeze more value from M&G with lower risk than a break-up.